net investment income tax 2021 trusts

Generally net investment income includes gross income from interest dividends annuities and royalties. Effective January 1 2013 Code Sec.

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Net investment income NII is income received from investment assets before taxes such as bonds stocks mutual funds loans and other investments less related.

. 2022-08-08 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of. April 28 2021 The 38 Net Investment Income Tax. Download or print the 2021 Federal Form 8960 Net Investment Income Tax - Individual Estates and Trusts for FREE from the Federal Internal Revenue Service.

These tax levels also apply to all income generated by estates. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted. This tax only applies to high-income taxpayers such as single filers who make more than 200000 and married couples who make more than 250000 as well as certain estates and trusts.

So for example if a trust earns 10000 in income during 2022 it would pay the following taxes. The standard rules apply to these four tax brackets. The estates or trusts portion of net investment income tax is calculated on Form.

1 It applies to individuals families estates and trusts. 2022 Long-Term Capital Gains Trust Tax Rates. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

Net Investment Income Tax - Individual Estates and Trusts 2021 Form 8960 Form 8960 Department of the Treasury Internal Revenue Service 99 Net. The Net Investment Income Tax does not apply to any amount of gain that is excluded from gross income for regular income tax purposes 250000 for single filers and. 10 of 2750 all earnings between 0 2750 275.

The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income.

/4592-f64c21a16a3847538c094ee48dee34fe.jpg)

Form 4952 Investment Interest Expense Deduction Definition

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

What Is A Charitable Remainder Trust Carolina Family Estate Planning

Form 8960 Net Investment Income Tax Individuals Estates An Trusts 8960 Pdf Fpdf

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Investor Education 2022 Tax Rates Schedules And Contribution Limits

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

Assault On Family Businesses Continues The S Corporation Association

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

3 8 Net Investment Income Tax Td T

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)

How To Analyze Reits Real Estate Investment Trusts

Trusts Estates And The Net Investment Income Tax Withum

Applying The New Net Investment Income Tax To Trusts And Estates

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

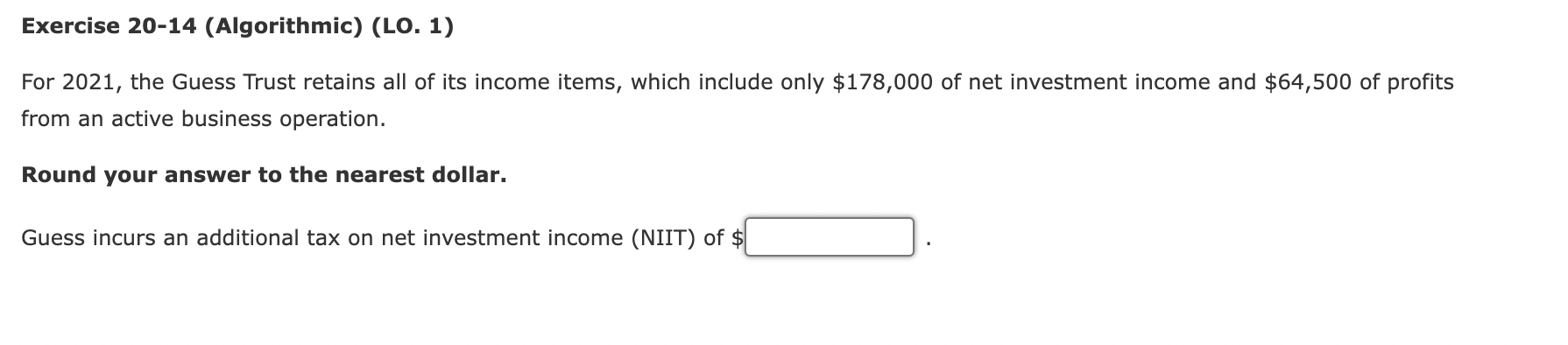

Solved Exercise 20 14 Algorithmic Lo 1 For 2021 The Chegg Com

Irs Issues Proposed Regulations On Trust And Estate Deductions

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)